[ad_1]

Loan sharks have been used by 3million Britons in last three years, as high street lenders turn customers away in cost of living crisis

- Some 2.8 million households have had a loan declined in last two years

- Illegal money lenders are now targeting customers who earn more

As many as three million people have turned to an illegal money lender in the past three years, raising concerns that more families may be at risk as the cost of living crisis continues to bite.

Some 7 per cent of 18 to 75 year-olds surveyed by polling firm Ipsos said that they or someone in their household had borrowed from an unlicensed or unauthorised informal money lender who charges interest – also known as a loan shark.

Research from not-for-profit organisation Fair4All Finance has also found that illegal money lenders appear to have moved upmarket, targeting lower-income workers with a median customer income of £20,000 – £24,999.

Struggling with costs: Around 7% of adults say either they know someone who has turned to an illegal lender or used on themselves

This group is better off than the poorest fifth of the population and may not have considered this option until recently, but has become more vulnerable as a result of rising costs.

Sacha Romanovitch, chief executive of Fair4All Finance said: ‘Our research suggests illegal lenders are flourishing in the credit vacuum left by the departure of high-cost yet regulated lenders. The unintended consequence is that millions of people who can well afford to repay a fair loan are left with fewer safe options.

‘There is a growing consensus that structural change is needed to create a credit market that serves everyone.’

Despite some improvements, consumer inflation has remained stubbornly high and was 8.7 per cent in May. Furthermore, supermarkets say food inflation has fallen for the second month in a row but remains at 14.6 per cent.

It came as a separate study found that one in four people say the struggle of being able to afford to put food on the table is causing real stress and has worsened their mental health.

>> Work out your household budget using This is Money’s calculator

While regulated lenders are required to perform affordability checks on loan applications, illegal lenders will often offer loans to those who cannot afford to repay as the interest will make them more money over the long term.

‘Your volume of money returned is astronomical, you know. The longer they couldn’t pay you back, the better,’ one illegal loan provider told researchers.

Charity the Joseph Rowntree Foundation recently reported that 2.8 million low income households had a loan application declined lending between May 2021 and May 2023, highlighting the lack of ‘safe’ credit options for lower-income households.

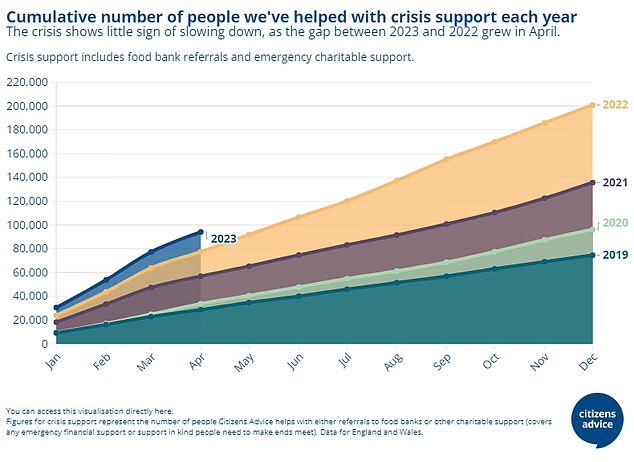

Citizens Advice data shows a similar trend. Between January and April this year the charity helped a record number of people with referrals for food banks or emergency charitable grants.

Citizens Advice has helped more people with crisis support than at the same point on record

One option for people struggling to borrow money legally to consider is a credit union.

These are financial co-operatives that provide savings, loans and a range of other services to their members. In order to join, credit unions usually require members to be part of a common bond, such as living within a designated area or working for a particular employer.

These organisations are often able to lend money to customers on more favourable terms than other high street lenders, and have schemes in place to assist more vulnerable borrowers who may struggle to access credit elsewhere.

Lauren Peel, director of consumer insights at Fair4All Finance said: ‘When it comes to credit and other financial services you might feel like you don’t have many good options right now, but Community Finance providers are here to help.

‘Responsible finance firms and credit unions will always check that a loan is affordable and may be able to help, even if you have been turned down by other providers.

‘Social lenders and credit unions have been around for decades and help many people avoid high cost lenders and illegal lenders, and build up savings.

‘While millions of people trust them for financial help, to borrow and save, lots of people don’t know about them.

‘Having access to credit in challenging financial times is part of your financial resilience and simply knowing your likely options should you need financial support can be a huge relief to people.’

Credit unions and responsible finance providers can be found at Find Your Credit Union, and Finding Finance.

[ad_2]